Loading

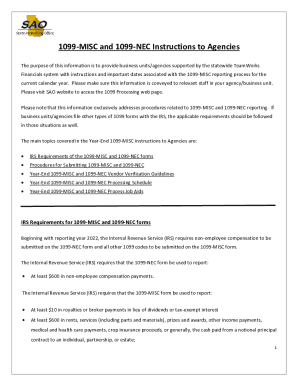

Get Ga 1099-misc Instructions To Agencies 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA 1099-MISC Instructions To Agencies online

This guide provides a straightforward approach to completing the GA 1099-MISC Instructions To Agencies form online. Follow these steps carefully to ensure accurate reporting and compliance with IRS requirements.

Follow the steps to fill out the GA 1099-MISC form online

- Press the ‘Get Form’ button to obtain the form and open it in your online editor.

- Review the IRS requirements for the 1099-MISC form. Ensure that you understand that this form is used to report various types of payments, including rents, prizes, and awards, as well as certain payments to attorneys.

- Complete the vendor information section by entering the vendor's name, address, and tax identification number (TIN). Ensure that all details are accurate to avoid any penalties.

- In the payment fields, accurately input amounts for each 1099 code applicable to the vendor. Verify that the amounts reflect the payments made during the reporting year.

- Review your entries against the 1099 Summary Report to ensure that all vendors and payment amounts are appropriately listed and correct.

- If necessary, make adjustments to the vendor information or payment amounts using the Adjust Withholding page.

- Once all necessary information has been entered and verified, save your changes. You can then download, print, or share the form as needed.

Complete your 1099-MISC documents online to ensure timely and accurate reporting.

Tip. You send a 1099-NEC form to any contractor who provides you with a total of $600 or more of services during the tax year. That includes advertising. If the advertising company is a corporation, however, you can skip the form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.