Loading

Get Withholding Forms - Ct.gov-connecticut's Official State ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Withholding Forms - CT.GOV-Connecticut's Official State ... online

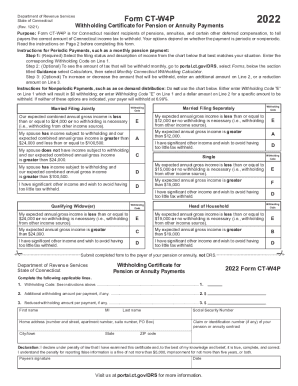

Filling out the Withholding Forms - CT.GOV-Connecticut's Official State ... is a crucial step for Connecticut residents receiving pensions or annuities. This guide provides a clear and structured approach to help you accurately complete the form online, ensuring the correct amount of tax is withheld from your payments.

Follow the steps to accurately fill out the Withholding Form online.

- Click the ‘Get Form’ button to obtain the form, allowing you to open it in your preferred editing tool.

- Select your filing status from the dropdown. This includes options such as Married Filing Jointly or Single. Ensure you enter the corresponding Withholding Code on Line 1, based on your income situation.

- If you would like to see an estimate of tax withholding, you can access the Monthly Connecticut Withholding Calculator from related online resources.

- Optionally, you can influence the withholding amounts further by entering any additional amount to withhold on Line 2, or a reduction amount on Line 3, as desired.

- If your payment is nonperiodic, ensure to enter Withholding Code 'E' on Line 1, which indicates no withholding, or specify an amount to be withheld on Line 2.

- After completing all necessary sections, review the form for accuracy and completeness.

- Save your changes, and then download or print the completed form. Submit the completed form directly to the payer of your pension or annuity.

Take action now and fill out your Withholding Forms online to ensure accurate tax withholding for your pension or annuity payments.

Is there any place I can go to get tax forms? A) Yes, you may visit a local IRS office or a post office or library that carries tax forms. You may also use computers that are often available for use in libraries to access IRS.gov to download needed forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.