Loading

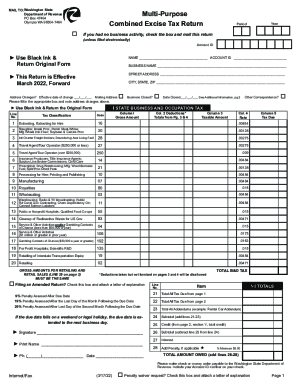

Get Wa Dor Multi-purpose Combined Excise Tax Return 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the WA DoR Multi-Purpose Combined Excise Tax Return online

The Washington State Department of Revenue Multi-Purpose Combined Excise Tax Return is an essential document for reporting various business activities. This guide provides clear, step-by-step instructions to assist users in filling out the form accurately and efficiently online.

Follow the steps to complete your tax return online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the account ID, name, and business name in the designated fields. Make sure the details are accurate to avoid processing delays.

- Provide your street address, city, state, and zip code. If you have any address changes, document them in the specified area.

- Indicate your tax classification and whether your business is closed by checking the appropriate boxes.

- Complete the State Business and Occupation Tax section by entering the gross amount, deductions, and taxable amount for each classification as applicable.

- Accumulate the total tax due by summing the amounts from relevant sections of the form.

- In the Additional Information section, specify any penalties if applicable. Note that unpaid taxes are subject to penalties and interest.

- Review the totals for state sales and use tax, local city and/or county sales and use tax, and other taxes. Ensure all amounts are tallied correctly.

- Fill in any credits you may qualify for, transferring totals as necessary from the deduction detail pages.

- Sign and print your name, include your phone number, and date the return. It is crucial to submit the original form.

- After completing all sections, save changes, download the form, print it for your records, or share it as needed. Ensure you mail the form to the designated address.

Complete your WA DoR Multi-Purpose Combined Excise Tax Return online today to stay compliant with tax regulations.

The federal government charges excise taxes on the sale or use of a wide variety of products. An excise tax isn't deductible if it's for a personal expense.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.