Loading

Get Ct Reg-8 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT REG-8 online

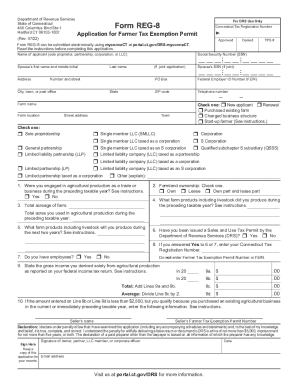

Filling out the CT REG-8 form is essential for individuals engaged in agricultural production who are seeking a tax exemption permit in Connecticut. This guide will provide clear instructions to assist you in completing the form accurately and efficiently online.

Follow the steps to successfully complete the CT REG-8 application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name as the applicant, which can be a sole proprietor, partnership, corporation, or LLC. Include the required Social Security Number (SSN) and, if applicable, your spouse’s first name and SSN for joint applications.

- Provide your mailing address, including street number and name, city or town, state, and ZIP code.

- Indicate your business structure by checking the appropriate box: sole proprietorship, general partnership, various types of limited liability companies, or corporation.

- Fill in the total acreage of your farm and the total acres you utilized for agricultural production in the previous taxable year.

- List the farm products you intend to produce in the upcoming two years, ensuring clarity and details for effective understanding.

- Answer the questions regarding your engagement in agricultural production. Confirm whether you have employees and if you have been issued a Sales and Use Tax permit by the Department of Revenue Services.

- State your gross income derived solely from agricultural production as reported on your federal income tax return. Fill out the corresponding fields for the last two taxable years.

- Complete any necessary attachments that are required based on your unique business circumstances, such as submitting federal tax return pages.

- Sign and date the application, confirming that the information provided is true and complete. Store a copy of the application for your records.

- Once you have filled out the application, you can save changes, download, print, or share the form as necessary.

Submit your CT REG-8 form online today to ensure you receive your Farmer Tax Exemption Permit.

If you are a resident in the state, Connecticut income tax withholding applies only to the taxable portion of IRA distributions. Therefore, if your withdrawal is a qualified distribution( opens in a new window ) there will be no income tax withheld.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.