Loading

Get Ct Cert-106 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT CERT-106 online

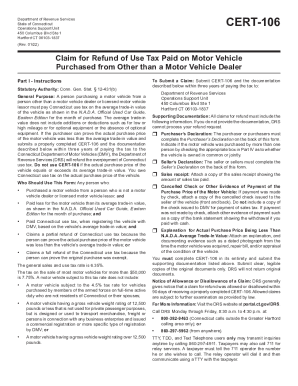

The CT CERT-106 is an essential form for individuals seeking a refund of use tax paid on motor vehicles purchased from non-dealers. This guide provides clear steps to assist you in completing the form accurately online.

Follow the steps to complete the CT CERT-106 form online.

- Click ‘Get Form’ button to access the CT CERT-106 and open it in your preferred editing tool.

- Fill out Part II, which requires information about the purchaser. Include the name, Social Security number, and address of the purchaser(s). Make sure to print clearly.

- Complete Part III to describe the motor vehicle. Include the date of purchase, date of registration, make, model, Vehicle Identification Number, year, and odometer reading on the date of purchase.

- In the Refund Calculation section, calculate the actual use tax by multiplying the actual purchase price by the applicable tax rate. Subtract this amount from what you paid to the DMV.

- Proceed to Part IV and complete the Purchaser’s Declaration. Ensure that the actual purchase price is correctly filled in and that signatures are provided.

- If applicable, provide the necessary details for any co-owners in the designated sections, ensuring all signatures are obtained.

- In Part V, the seller must complete their declaration, providing their information, signature, and date, just as the purchaser did.

- Prepare and attach all required supporting documentation as outlined in the instructions. This includes sales receipts, evidence of payment, and any explanations of the purchase price being lower than the average trade-in value.

- Review the completed form and documentation for clarity and correctness. Once satisfied, save your changes, and prepare to print or share the form as needed.

Complete the necessary forms and file online to ensure your claim is processed efficiently.

To apply for an initial or renewal tax exemption card, eligible missions and their members should submit an application on the Department's E-Government (E-Gov) system. Applications are generally processed within five business days.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.