Loading

Get Me Rew-2 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ME REW-2 online

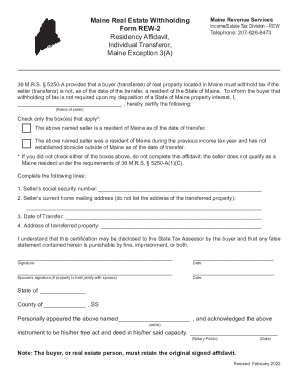

Filling out the ME REW-2 form online is an important step for sellers of real estate in Maine to certify their residency status. This guide provides clear and step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the ME REW-2 online form.

- Click 'Get Form' button to access the ME REW-2 online form and open it in the browser.

- In the first section, certify the residency status by checking the appropriate box(es). Ensure you check only the boxes that apply regarding your residency in Maine.

- Fill in your name as the seller in the designated space provided below the certification section.

- Provide the seller’s social security number in the specified field. This information is necessary for tax purposes.

- Enter the seller’s current home mailing address. It should not be the address of the transferred property.

- Indicate the date of transfer in the appropriate field, ensuring it reflects the actual date of the real estate transaction.

- Fill in the address of the transferred property in the designated section.

- Sign and date the form where indicated, and ensure to provide your spouse’s signature if the property is jointly held.

- Complete the notary section as required, ensuring that it includes the correct state and county information, as well as the notary’s signature and date.

- Review the completed form for accuracy before finalizing. You can save changes, download, print, or share the completed form as needed.

Complete your ME REW-2 form online today to ensure a smooth real estate transaction.

*$244,900 is the median home value in the U.S. as of 2021, the year of the most recent available data....Real-Estate Property Tax Rates by State. Rank (1=Lowest)36StateMaineEffective Real-Estate Tax Rate1.28%Annual Taxes on $244.9K Home*$3,143State Median Home Value$212,10050 more columns • Feb 21, 2023

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.