Loading

Get Ri Tx-13 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RI TX-13 online

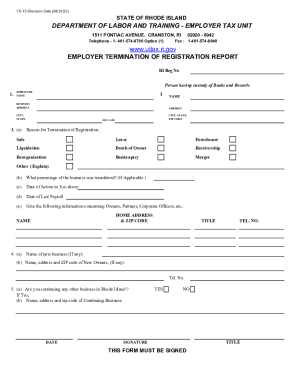

The RI TX-13 form is essential for employers terminating their registration in Rhode Island. This comprehensive guide will help you navigate each section of the form to ensure it is filled out accurately and submitted correctly.

Follow the steps to complete the RI TX-13 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your Rhode Island registration number in the designated field. This identifies your business registration with the state.

- Enter the name of the employer in the ‘Employer Name’ section. Make sure to include the full legal name as registered.

- Fill out the business address, including street address, city, and state. Ensure that all details are accurate to avoid complications.

- In the reason for termination of registration, select one of the options provided (e.g., sale, bankruptcy). If applicable, describe any other reason in the space indicated.

- If relevant, indicate what percentage of the business was transferred and fill in the corresponding date of action.

- Report the date of your last payroll, which is crucial for the state's records.

- Provide information concerning owners, partners, or corporate officers, including their names, titles, and home addresses with ZIP codes.

- If applicable, input the name and contact information of any new business or owners resulting from the termination.

- Indicate whether you will continue any other business in Rhode Island. If yes, include the new business’s name, address, and ZIP code.

- Sign the form where indicated, including your title, to certify the information provided is accurate.

- Once filled, review your entries for accuracy before saving your changes and downloading or printing the completed form.

Start completing your documents online today.

4.62% of total high quarter wages in base period. benefit rate (up to 5 deps.)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.