Loading

Get Fl Dr-7n 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-7N online

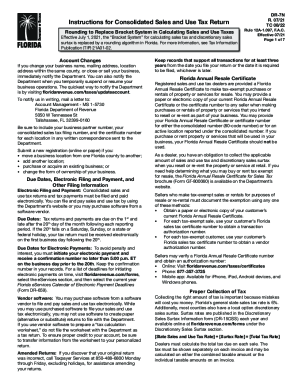

The FL DR-7N is a crucial document for reporting consolidated sales and use tax in Florida. Filling out this form accurately is essential for compliance with state tax regulations. This guide provides you with a step-by-step approach to complete the FL DR-7N online, ensuring that you understand each section and requirement.

Follow the steps to accurately complete the FL DR-7N online.

- Click ‘Get Form’ button to obtain the FL DR-7N and open it in your preferred online editor.

- Begin by entering your business details at the top of the form, including your business name, address, and tax registration number.

- Proceed to Line A, where you will report your total sales. Include all applicable sales transactions but exclude any sales tax collected.

- On Line B, calculate and report any taxable purchases you consumed or used for which use tax is applicable.

- Continue to Line C and report your amounts for commercial rentals. Ensure to capture the total consideration charged and avoid including tax collected.

- For Line D, document any transient rentals, detailing the gross amounts charged while excluding tax.

- Complete Line E by calculating and reporting your food and beverage vending sales using the designated divisor for your county.

- Add up the tax due from each line in Column 4 and report it on Line 5 to reflect the total amount of tax liability.

- After completing all applicable lines, review your entries for accuracy to avoid errors or omissions.

- Once finalized, you can save the form changes, download, print, or share it as needed.

Start filling out your FL DR-7N online today to ensure compliance with Florida tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can pay bills (Notice of Amount Due or Demand for Payment) online for most taxes using an ACH-Debit or credit card.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.