Loading

Get Fl Dr-534 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-534 online

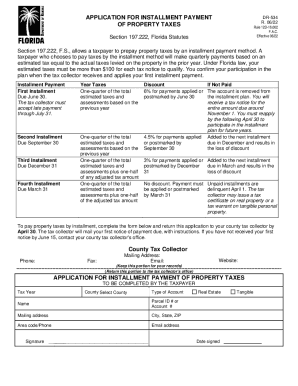

Filling out the FL DR-534 application for installment payment of property taxes can seem daunting, but with a clear guide, it becomes manageable. This document allows taxpayers to prepay property taxes in installments, providing a more manageable approach to fulfilling tax obligations.

Follow the steps to successfully complete the FL DR-534 form.

- Click the ‘Get Form’ button to access the application form and open it in your preferred editor.

- Identify and enter the tax year for which you are applying for installment payments in the designated field.

- Select your county from the dropdown list to ensure your application is directed to the correct office.

- Choose the type of account for which you are making the payment (Real Estate or Tangible) by checking the appropriate box.

- Fill in your name in the 'Name' section as it appears on your tax documents.

- Input your Parcel ID number or Account number in the corresponding field to identify your property correctly.

- Provide your mailing address, including city, state, and ZIP code to ensure you receive all correspondence related to your application.

- Enter your area code and phone number in the appropriate fields for the tax collector to reach you, if necessary.

- Fill out your email address to ensure you receive notifications and updates regarding your application.

- Sign the form in the designated signature area to confirm that the information provided is accurate.

- Date your signature to complete the application process.

- Review all the information to ensure accuracy before submitting. You can then save changes, download, print, or share the completed form as needed.

Complete the FL DR-534 form online today to manage your property tax payments effectively.

Property Tax Exemptions and Additional Benefits Further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military service members, disabled first responders, and properties with specialized uses.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.