Loading

Get Fl Rts-70 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL RTS-70 online

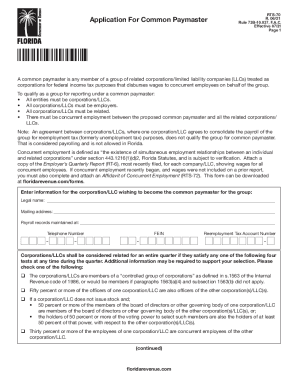

The FL RTS-70 form is essential for corporations and limited liability companies in Florida that wish to qualify as common paymasters. This guide will provide you with clear, step-by-step instructions to help you fill out the form accurately and efficiently online.

Follow the steps to complete the FL RTS-70 online.

- Press the ‘Get Form’ button to obtain the FL RTS-70 form and open it in your preferred online editor.

- Fill in the legal name of the corporation or LLC that intends to act as the common paymaster for the group.

- Provide the mailing address for the corporation or LLC in the designated field.

- Enter the location where payroll records are maintained in the corresponding section.

- Include the telephone number for the primary contact regarding the common paymaster application.

- Input the Federal Employer Identification Number (FEIN) in the specified field.

- Enter the reemployment tax account number as required.

- Select one of the options that describe the relationship of the corporations/LLCs and provide supporting information if required.

- List the legal names and reemployment tax account numbers of related corporations and LLCs if applicable.

- Review the application carefully for accuracy before signing it.

- Sign the application, print your name, indicate your official position, and provide the date of signing.

- Submit the completed form to the Florida Department of Revenue at the address indicated or follow your organization's submission protocol.

- You may save the changes, download, print, or share the filled-out form based on your preference.

Complete your FL RTS-70 form online today for efficient processing and compliance.

Florida Data SeriesSept 2022Dec 2022Civilian Labor Force(1)(r)10,827.2(r)10,839.8Employment(1)(r)10,532.8(r)10,549.0Unemployment(1)(r)294.4(r)290.8Unemployment Rate(2)(r)2.7(r)2.727 more rows

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.