Loading

Get Mw507

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mw507 online

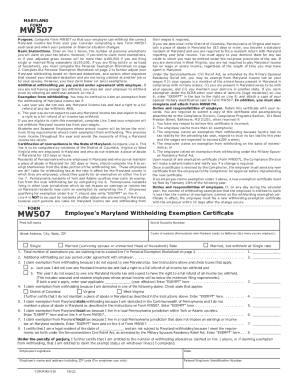

Filling out the Mw507 form is essential for ensuring your employer withholds the correct amount of Maryland income tax from your pay. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the Mw507 online.

- Click 'Get Form' button to obtain the Mw507 form and open it in the editor.

- On Line 1, enter the number of personal exemptions you will claim on your tax return. If you wish to claim more exemptions than usual or your adjusted gross income exceeds specific thresholds, complete the Personal Exemption Worksheet on page 2.

- On Line 2, if you feel that not enough tax is being withheld from your pay, enter an additional amount for withholding per pay period. This should be agreed upon with your employer.

- For Line 3, determine if you qualify for an exemption from withholding. You may claim this if you did not owe any Maryland income tax last year and expect not to owe any this year either. If eligible, check the applicable boxes and enter the effective year.

- On Line 4, if you are a resident of the District of Columbia, Virginia, or West Virginia and do not maintain a place of abode in Maryland for at least 183 days, certify this by filling this line.

- For Line 5, Pennsylvania residents should indicate their state of domicile and confirm they do not reside in Maryland for the required days. Complete this to exempt themselves from Maryland withholding tax.

- Line 6 and Line 7 pertain to local tax exemptions for Pennsylvania residents based on their local jurisdiction. Complete these lines as applicable to claim these exemptions.

- On Line 8, if you are a legal resident of another state and are entitled to exemption under the Servicemembers Civil Relief Act, enter your state of domicile and check 'EXEMPT'. Attach the required documents as indicated.

- Once all sections are completed, review the entire form for accuracy. Save your changes, download, print, or share the form as necessary.

Complete your Mw507 form online today to ensure your tax withholdings are accurate.

Claiming 0 Allowances on your W4 ensures the maximum amount of taxes are withheld from each paycheck. Plus, you'll most likely get a refund back at tax time.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.