Loading

Get De Pit-und 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DE PIT-UND online

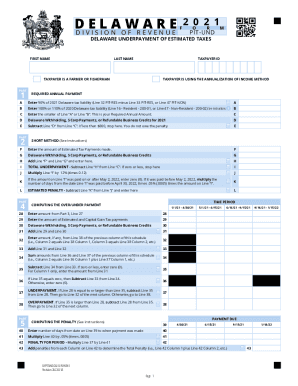

The DE PIT-UND form is essential for reporting the underpayment of estimated taxes in Delaware. This guide provides a clear, step-by-step approach to completing the form online, ensuring that all users can navigate the process with ease and confidence.

Follow the steps to fill out the DE PIT-UND form online effectively.

- Click the ‘Get Form’ button to obtain the document and open it in your preferred editor.

- Begin by entering your first name and last name in the designated fields. Ensure that the names match the details on your tax identification.

- Fill in your taxpayer ID number accurately in the corresponding field to avoid processing delays.

- Indicate whether the taxpayer is a farmer or fisherman by checking the appropriate box.

- If using the annualization of income method, check the necessary box provided.

- In Part 1, calculate the required annual payment: on Line A, enter 90% of your 2021 Delaware tax liability. On Line B, provide either 100% or 110% of your 2020 Delaware tax liability.

- On Line C, enter the smaller of Line A or Line B. This value represents your required annual amount.

- Proceed to Line D and enter any Delaware withholding, S Corporation payments, or refundable business credits for the year 2021.

- Subtract Line D from Line C on Line E. If the result is less than $800, you do not owe a penalty.

- In Part 2, record the amount of estimated tax payments made on Line F and any Delaware withholding, S Corporation payments, or refundable credits on Line G.

- Add Line F and Line G on Line H and subtract this total from Line C on Line I to determine your total underpayment.

- If needed, calculate the penalty in Part 4 by following the instructions for Lines 39 through 42.

- Once all information is filled in and verified, save your changes. You can then download, print, or share the completed DE PIT-UND form as needed.

Complete your DE PIT-UND form online today for a seamless filing experience.

The state does not have a corporate tax on interest or other investment income that a Delaware holding company earns. If a holding corporation owns fixed-income investments or equity investments, it isn't taxed on its gains on the state level. Delaware also does not have any personal property tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.