Loading

Get Md 433 A

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Md 433 A online

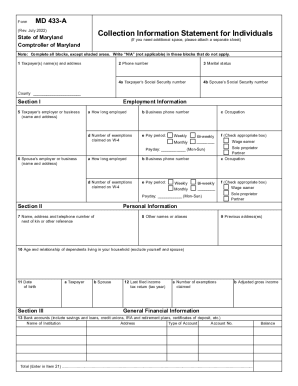

Filling out the Md 433 A, also known as the Collection Information Statement for Individuals, is an essential step for individuals in Maryland to report their financial status. This guide provides clear and supportive instructions on how to complete this form online.

Follow the steps to effectively fill out the Md 433 A online

- Press the ‘Get Form’ button to access the Md 433 A form and open it in your online editor.

- Begin by entering the taxpayer(s) name(s) and address in Section 1. Ensure that the information is accurate, as it is crucial for identification purposes.

- Provide a valid phone number for contact. This will help the Comptroller’s office reach you if needed.

- Indicate your marital status, which is typically required for financial disclosures.

- In Section I, fill in the taxpayer's Social Security number and, if applicable, the spouse's Social Security number in the designated fields.

- Complete the employment information for both the taxpayer and spouse. Include current employers' names and addresses, how long they have been employed, their occupations, and the number of exemptions claimed on their W-4 forms.

- In Section II, provide personal information such as next of kin details, any other names or aliases used, and previous addresses if applicable.

- Enter relevant financial information in Section III, including bank accounts, charge cards, real properties owned, life insurance policies, and securities. Ensure each field is filled out correctly to reflect your current financial state.

- In the asset and liabilities section, clarify the values of any vehicles, real properties, and other assets owned, along with debts or liabilities associated with them.

- Complete the income and expense analysis at the end of the form. Accurately tally all sources of income and necessary living expenses.

- Finally, review the entire document to ensure all information is correct. Save any changes you made, and download, print, or share the completed form as necessary.

Get started by filling out your Md 433 A form online today!

What are the main benefits of the tax amnesty? If you file and pay within the amnesty period, Maryland will drop the civil penalties and charge you only half the accrued interest. In most cases you'll be immune from criminal tax charges and penalties for the affected returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.