Loading

Get Ar Dfa Ar1000cres 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR DFA AR1000CRES online

Filling out the AR DFA AR1000CRES is an essential step for taxpayers in Arkansas looking to declare their estimated taxes for the income year. This guide will provide you with clear, step-by-step instructions to ensure the process is straightforward and accessible for all users.

Follow the steps to complete the AR DFA AR1000CRES form effectively.

- Begin by clicking the ‘Get Form’ button to access the AR DFA AR1000CRES online. This will allow you to retrieve the form and open it for editing.

- Once the form is open, start by entering your name, address, and Federal Identification Number in the relevant fields. Ensure that all details are accurate to avoid processing issues.

- Next, fill in the ‘Fiscal Year Ending’ date in the specified format (MM/DD/YYYY) to denote the tax year for your estimate.

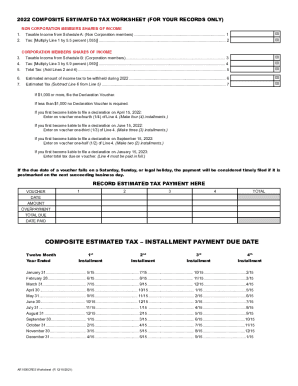

- Proceed to calculate your estimated tax by using the Estimated Tax Worksheet. Carefully consider your financial circumstances and utilize your previous year’s tax return for reference.

- After completing the worksheet, enter one-fourth of the calculated tax amount into the ‘Amount of This Payment’ space on the voucher.

- If you are claiming an overpayment from the previous tax year, ensure to indicate this in the appropriate section of the form.

- Attach your payment (if applicable) by including a check or money order made out to the Department of Finance and Administration, and make sure to write your Federal Employer Identification Number on it.

- Review the completed form for any errors or omissions before proceeding to submit it. Confirm all fields are filled correctly.

- Finally, save your changes, and download, print, or share the completed form as necessary to ensure your Declaration of Estimated Tax is filed on time.

Complete your AR DFA AR1000CRES form online today for a smooth filing experience!

Visit our website: https://.dfa.arkansas.gov/income-tax/arkansas-efile/freefile-program-for-individual-income-tax/ for vendors and their requirements. Please allow six to eight weeks for the processing of your paper returns. When e-filed returns are accepted, please allow two to four weeks for processing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.