Loading

Get Ky 42a741 2002-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY 42A741 online

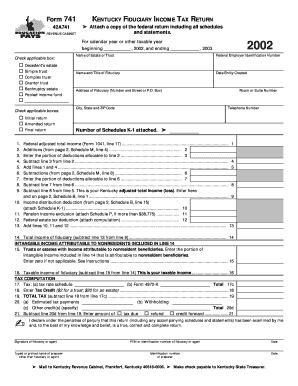

The KY 42A741 form is the Kentucky fiduciary income tax return, essential for reporting the income of trusts and estates. This guide provides a clear, step-by-step approach to completing the form online, ensuring users can navigate it with ease.

Follow the steps to fill out the KY 42A741 form online successfully.

- Click the ‘Get Form’ button to access the KY 42A741 form and open it in your browser.

- Enter the calendar year or other taxable year for the return. Specify the beginning and ending dates.

- Check the box that corresponds to the type of trust or estate you are filing for (simple trust, complex trust, grantor trust, bankruptcy estate, pooled income fund).

- Provide the Federal Employer Identification Number of the fiduciary. Follow this with the name and title of the fiduciary.

- Include the date the entity was created and the name of the estate or trust.

- Indicate whether this is the initial return, an amended return, or a final return.

- Fill in the address of the fiduciary, including the number and street or P.O. Box, city, state, and ZIP code.

- List the room or suite number and the telephone number of the fiduciary.

- Specify the number of Schedules K-1 attached to this return.

- Complete the income and deduction sections accurately based on the income received and applicable deductions, ensuring to follow the calculations provided in the form.

- Enter the total tax calculated. Remember to account for any tax credits applicable.

- Indicate whether there is tax due, a refund, or a credit to be forwarded.

- Sign the form, indicating that the information provided is true and complete to the best of your knowledge.

- After completing the form, save changes, and optionally download or print it for your records prior to submission.

Complete your KY 42A741 form online today for a streamlined filing experience.

Form K-5. Form K-5 is used to report withholding statement information from Forms W-2, W-2G, and 1099 and is completed online with two filing methods to choose from. It may be filed electronically by clicking the submit button or the completed form may be printed and mailed to the address on the form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.