Loading

Get Ky 42a741 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY 42A741 online

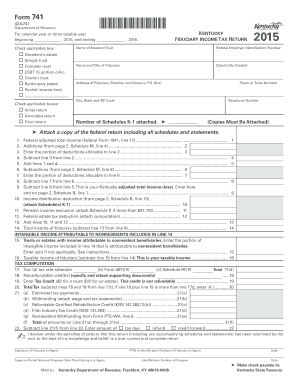

The KY 42A741 is the Kentucky fiduciary income tax return form, designed for various estate and trust tax purposes. Filling out this form online can simplify the process of reporting income for estates, trusts, and certain related entities.

Follow the steps to complete your KY 42A741 online

- Press the ‘Get Form’ button to access the KY 42A741 form and open it in the online editor.

- Indicate the applicable tax year at the top of the form by filling in the beginning and ending dates for the taxable year, which should align with your estate or trust accounting period.

- Check the appropriate box for the type of entity you are filing for, such as a decedent's estate, simple trust, or complex trust.

- Identify whether this is your initial, amended, or final return by marking the relevant checkbox.

- Fill in the name of the estate or trust and its Federal Employer Identification Number (EIN).

- Provide the name and title of the fiduciary managing the estate or trust.

- Enter the date the entity was created, along with the fiduciary's address, including the street number, room or suite number, city, state, and ZIP code.

- Input the telephone number for the fiduciary contact.

- State the number of Schedules K-1 attached to the return, ensuring that copies of these schedules are included.

- Proceed to complete the income and deductions sections, including federal adjusted total income, additions and subtractions, and ensure you attach the necessary federal return schedules.

- Fill out the tax computation section thoroughly, specifying any nonrefundable credits and deductions as indicated.

- At the bottom of the form, the fiduciary or an authorized agent must sign and date, declaring the accuracy of the submitted information.

- After completing all sections, save your changes, and you may choose to download, print, or share the filled form as needed.

Complete your KY 42A741 form online today for a streamlined filing experience.

E-file your Kentucky personal income tax return online with 1040.com. These 2021 forms and more are available: Kentucky Form 740/740-NP – Personal Income Tax Return for Residents / Nonresidents or Part-Year Residents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.