Loading

Get Mi Poverty Application - West Bloomfield Township 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI Poverty Application - West Bloomfield Township online

Filling out the MI Poverty Application for West Bloomfield Township online is a crucial step for those seeking property tax relief due to financial hardship. This guide will provide clear, step-by-step instructions to help you navigate the form with ease, ensuring all necessary information is accurately provided.

Follow the steps to complete the application efficiently.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter your personal information in the designated fields. This includes the primary applicant’s name, age, address, and contact details. Ensure that the information is current and accurate for verification purposes.

- Provide details about your property, including the taxable value of your homestead and parcel number. If you have lived at your current address for less than ten years, also include your previous address and its property value.

- Indicate your marital status and employment status by checking the appropriate boxes. If applicable, provide additional information regarding any disabilities or health issues affecting you or your spouse.

- List all additional owners and residents living on the property along with their ages, relationships, and employment statuses. This section is crucial for determining eligibility.

- Gather the required documentation, such as copies of Federal and Michigan income tax returns for the past three years, proof of income, bank statements, and identification. Ensure that all documents are complete and unaltered.

- Review your total household income from all sources and list it accurately. Make sure to include all required income information from all residents in the household.

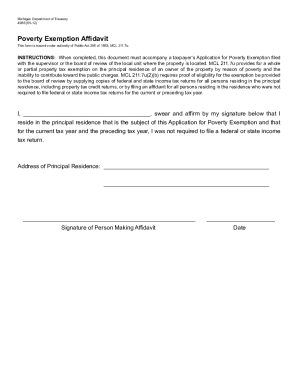

- If applicable, complete and attach the Poverty Exemption Affidavit (form 4988) for any household members who were not required to file tax returns.

- Carefully read the Authorization to Verify Application and Inspect Property section before signing. Ensure all required signatures from owners and occupants are obtained.

- Finally, save any changes made to the form, and choose to either download, print, or share the completed application, ensuring it is submitted before the December 1st deadline.

Begin the process of completing your MI Poverty Application online today to secure your potential tax relief.

What are residential setback requirements? In a R-1, R-2, and R-3 One-Family Residential District, a parcel requires 16'-0" side setbacks, 40'-0" front setback and a 35'-0" rear setback. A corner parcel with two street fronts is considered two front yards.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.