Loading

Get De Pit-res Instructions 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DE PIT-RES Instructions online

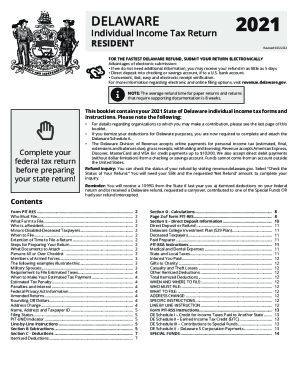

Filling out the DE PIT-RES Instructions online can simplify the process of submitting your Delaware individual income tax return. This guide provides clear, step-by-step directions to help you navigate the form effectively, ensuring a smooth filing experience.

Follow the steps to successfully complete your tax return online.

- Press the ‘Get Form’ button to access the DE PIT-RES Instructions and open the form in your preferred online editor.

- Begin by completing your federal tax return, as the information will be critical for preparing your Delaware return.

- Fill in your personal details including your name, address, and filing status. Ensure this information matches your identification documents.

- Using the line-by-line instructions provided in the DE PIT-RES document, complete the relevant sections of the form in the specified order.

- Attach any necessary documentation as instructed, such as W-2 forms and other supporting documents required for your deductions and credits.

- Once completed, review the entire form for accuracy, ensuring all sections are properly filled out.

- Sign and date your form, and include a phone number where you can be contacted during business hours.

- Finally, save your changes, and choose to download, print, or share your completed form as necessary.

Start filing your DE PIT-RES Instructions online today for a faster tax processing experience.

Related links form

Who has to file Delaware state taxes? Delaware age and income requirements to file taxesAgeSingleMarried, filing jointlyUnder 60More than $9,400More than $15,45060-64More than $12,200More than $17,95065 and above, or blindMore than $14,700More than $20,4502 more rows • Jan 6, 2022

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.