Loading

Get De Pit-non 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DE PIT-NON online

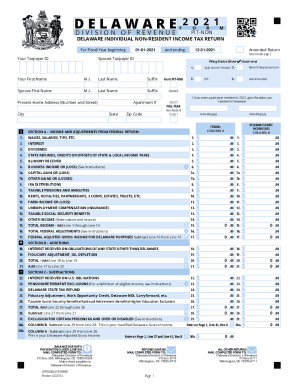

The DE PIT-NON is a crucial document for individuals who need to file their Delaware individual non-resident income tax return. This guide provides a step-by-step approach to filling out this form accurately and efficiently online.

Follow the steps to complete your DE PIT-NON online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your taxpayer ID at the top of the form, ensuring accuracy to avoid issues with your filing.

- Fill in your personal information, including your first name, middle initial, last name, and suffix, followed by your spouse's information if applicable.

- Provide your present home address, including the number and street, city, state, and zip code.

- Select your filing status by checking the appropriate box, which describes your situation accurately.

- For part-year residents, enter the dates of residency in Delaware, following the specified format.

- Complete Section A by listing your income and adjustments from your federal return, ensuring you provide accurate figures in the correct columns.

- Continue to Sections B and C, adding any required information regarding additions and subtractions to your income.

- In Section D, enter total itemized deductions if applicable, and any foreign taxes paid or charitable mileage deductions.

- Finish calculating your tax liability in Section E, ensuring that all calculations are performed accurately.

- Complete Section F, providing direct deposit information if you wish to receive your refund via this method.

- Ensure to sign your return and keep a copy for your records before submitting.

- Once all fields are completed, save your changes, download, print, or share the completed form as necessary.

Complete your DE PIT-NON online today to ensure an accurate and timely tax return.

Employers Depositing Only Personal Income Tax (PIT) Withholding (Including Payers of Pensions and Annuities)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.