Get Dc D-4 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DC D-4 online

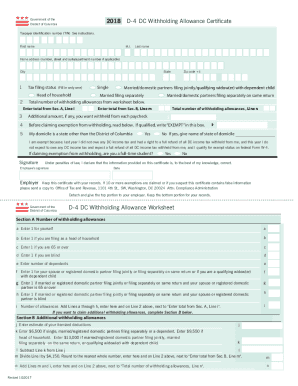

The DC D-4 Withholding Allowance Certificate is an important document for employees who need to have their DC income taxes withheld. Completing this form accurately will ensure that the correct amount of tax is deducted from your paycheck. This guide provides step-by-step instructions to help you fill out the DC D-4 online with ease.

Follow the steps to complete the DC D-4 form online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter your taxpayer identification number (TIN) in the designated field. This may be your Social Security number or another form of TIN.

- Fill in your first name, middle initial, and last name in the corresponding fields, ensuring accurate spelling.

- Provide your home address, including the number, street, suite or apartment number if applicable, followed by your city, state, and zip code +4.

- Select your tax filing status by filling in only one of the specified options, such as married/domestic partners filing jointly or head of household.

- Calculate the total number of withholding allowances using the worksheet provided. Enter this total in the appropriate field.

- If you wish to have an additional amount withheld from each paycheck, specify that amount in the designated box.

- If you believe you are exempt from withholding, read the qualifications and, if applicable, write 'EXEMPT' in the specified box.

- Indicate whether your domicile is a state other than the District of Columbia by selecting 'Yes' or 'No.' If yes, provide the name of the state.

- Answer the question about being a full-time student if claiming exemption from withholding, and provide an appropriate response.

- Sign and date the certificate, declaring that all information provided is accurate to the best of your knowledge.

- Once completed, detach the top portion of the form to give to your employer. Retain the bottom portion for your records and consider saving changes, downloading, or printing the document as needed.

Complete and file your DC D-4 form online today for accurate income tax withholding.

0:33 5:03 Accountant Reads California DE4 Instructions - YouTube YouTube Start of suggested clip End of suggested clip Or had a household. So you'll use the single or married with more than with two or more incomes. IfMoreOr had a household. So you'll use the single or married with more than with two or more incomes. If both spouses work or even if just once both works but they've got two jobs.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.