Loading

Get Nj Dot Rtf-3 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ DoT RTF-3 online

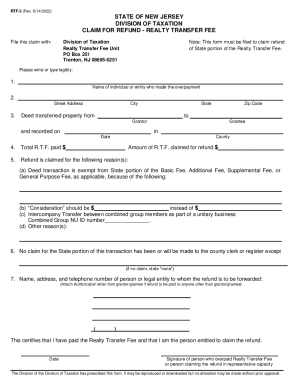

Filling out the NJ Department of Transportation RTF-3 form is a crucial step for individuals and entities seeking a refund of the Realty Transfer Fee paid in New Jersey. This guide provides clear, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to successfully complete the NJ DoT RTF-3 form online.

- Press the ‘Get Form’ button to access the RTF-3 online form and open it in your preferred editor.

- In the first section, provide the name of the individual or entity that made the overpayment. Be sure to write or type this information clearly.

- Next, fill in the street address, city, state, and zip code where the individual or entity resides.

- Indicate the details of the property deed that was transferred, including the names of the grantor and grantee, and the date when the deed was recorded, as well as the county.

- Enter the total amount of Realty Transfer Fee paid, along with the amount being claimed for a refund.

- Select the reason for claiming the refund from the specified categories, and provide relevant details to support your claim.

- Indicate if a claim has been made to the county clerk or register. If not, write 'none'.

- In the final section, provide the name, address, and phone number of the person or legal entity to which the refund should be sent. Remember to attach an authorization letter if the refund is going to someone other than the grantor or grantee.

- Certify your claim by signing and dating the form. Make sure that the signature is from the person who overpaid the Realty Transfer Fee or the authorized representative.

- After completing all sections, review your form for accuracy. You can then save changes, download the completed form, print it, or share as required.

Complete your NJ DoT RTF-3 form online today for a hassle-free refund process.

65 or older as of December 31, 2021; or. Actually receiving federal Social Security disability benefit payments (not benefit payments received on behalf of someone else) on or before December 31, 2021, and on or before December 31, 2022.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.