Loading

Get Pr Form 480.20(u) 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the PR Form 480.20(U) online

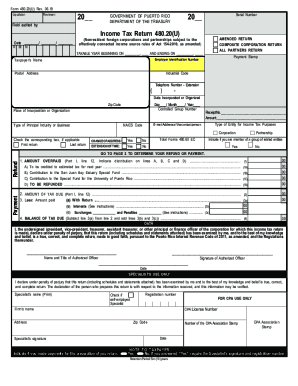

Filling out the PR Form 480.20(U) online can streamline the process of submitting your income tax return. This guide provides clear, step-by-step instructions tailored to help users complete the form efficiently and accurately.

Follow the steps to complete your PR Form 480.20(U) online:

- Press the 'Get Form' button to access the PR Form 480.20(U) and open it in your preferred online editor.

- Begin by entering the taxpayer's name and employer identification number in the designated fields at the top of the form. Ensure that the information is accurate for proper processing.

- Indicate the tax year by filling in the beginning and ending dates of the taxable year as required. This is crucial for accurate tax reporting.

- In the 'Type of Entity for Income Tax Purposes' section, check the applicable box to specify whether the entity is a corporation, partnership, or another type. This section is important for understanding your tax obligations.

- Complete the section regarding the income tax calculations. Make sure to enter all required financial figures, such as net income and applicable deductions, in the correct lines as per the guidelines provided.

- If applicable, indicate whether this is the first or last return by checking the corresponding box. This is needed if you are dealing with specific tax circumstances.

- In the 'Oath' section, ensure that an authorized officer of the corporation or partnership signs and dates the form. This affirms that the information provided is true and correct.

- Review all entries thoroughly to ensure that all information is complete and correct. It's advisable to double-check for any potential errors that could cause processing delays.

- Once completed, you can save your changes, download the form for your records, print it if necessary, and share it as required.

Complete your PR Form 480.20(U) online today for a smoother filing experience!

Puerto Rico Income Tax If your LLC is taxed as a Puerto Rico corporation, you'll need to pay corporate income tax. Puerto Rico's corporate tax rate is 37.5%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.