Loading

Get Va Vm-2 2005-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA VM-2 online

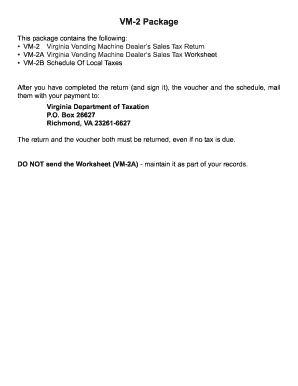

The Virginia Vending Machine Dealer’s Sales Tax Return, known as the VM-2, is an essential document for vending machine operators in Virginia to report their sales tax obligations. This guide provides clear and precise instructions to help users navigate the online version of the VM-2 form effectively.

Follow the steps to complete the VA VM-2 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Carefully read the instructions provided on the form to understand each section and its requirements.

- Enter your account number in the designated field. This number identifies your business's tax account.

- Fill in the period for which you are reporting sales tax. Ensure the dates are correct to avoid filing issues.

- Provide your name and the business name in the appropriate sections to identify the entity filing the return.

- In Column A, list the items sold via vending machines and their associated costs in Column B for state tax and Column C for local tax.

- Calculate your total deductions based on the allowable criteria provided in the form instructions and enter them in the respective fields.

- Compute your total taxable amount by subtracting total deductions from the total sales amount, and record this figure in the corresponding section.

- Determine the applicable state and local tax rates based on the instructions and enter these calculations into Columns B and C.

- Calculate any dealer's discount, if applicable, based on the total sales and adhere to the guidelines for entering this information.

- Finally, ensure all figures are correct, sign the return, and date it, confirming the information is accurate, truthful, and complete.

- After completing the form, review it for accuracy, then proceed to save changes, download, print, or share the form as needed.

Complete your VA VM-2 form online today and ensure timely submission.

Check - If you do not want to pay electronically, you may e-file your return and mail a paper check for your payment. Online Services - Virginia Tax's Online Services for Individuals is a free online tax payment system that allows you to make payments directly from your checking or savings accounts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.