Loading

Get Al Form 40es 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL Form 40ES online

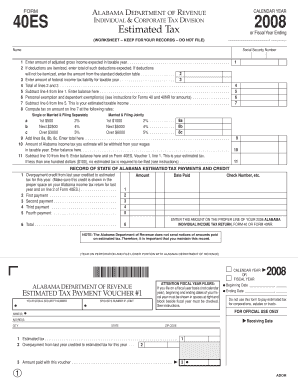

The AL Form 40ES is a critical document for individuals expecting to owe estimated taxes in Alabama. Completing this form accurately is essential for ensuring correct tax reporting and meeting your obligations. This guide will provide step-by-step instructions for effectively filling out the form online.

Follow the steps to complete the AL Form 40ES accurately.

- Press the ‘Get Form’ button to access the form and open it in the online editor. This will allow you to fill in your details effortlessly.

- In the first field, enter your expected adjusted gross income for the taxable year. Ensure all figures are accurate and reflective of your financial situation.

- If you plan to itemize deductions, input the total of those deductions in the appropriate field. If opting for the standard deduction, enter the amount as dictated by the standard deduction table.

- Next, provide the amount of your federal income tax liability for the taxable year. This helps establish your overall tax picture.

- Sum the amounts from the deduction and federal tax fields and enter the total. This total will be used in subsequent calculations.

- Subtract the total from the previous step from your expected gross income and record the result in the respective field.

- Input any personal and dependent exemption amounts as instructed. Refer to the related instructions for the appropriate amounts.

- Subtract the results from the previous step to determine your estimated taxable income and input it in the designated area.

- Follow the specific tax rate instructions to calculate your tax liability based on your filing status. Enter each amount accordingly.

- Record your withholding amount expected for the year and subtract this total from your tax liability.

- Enter the final estimated tax amount calculated. Ensure that if this amount is less than $100, you note that no estimated tax is required to be filed.

- Finally, review all inputs for accuracy and save your changes. Once satisfied, you can download, print, or share the completed form as needed.

Complete your tax forms online today to ensure compliance and avoid penalties!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.