Loading

Get Au Keystart Mortgage Discharge Request 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AU Keystart Mortgage Discharge Request online

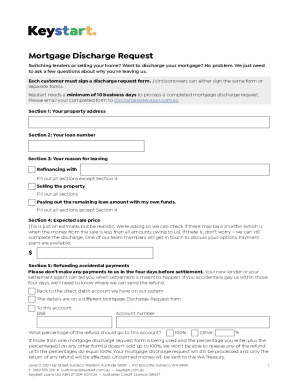

Filling out the AU Keystart Mortgage Discharge Request online can simplify the process of discharging your mortgage. This guide will walk you through each step to ensure a smooth experience as you transition to a new lender or sell your property.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the discharge request form and open it for editing.

- In Section 1, enter the address of your property. Ensure this information is accurate to avoid delays.

- In Section 2, provide your loan number. This number is essential for Keystart to identify your account.

- In Section 3, indicate your reason for leaving Keystart. Choose from options like refinancing, selling the property, or paying out the loan with your own funds. Fill out all sections except Section 4, depending on your selected reason.

- In Section 4, if applicable, provide an estimated expected sale price for your property. Realistic estimates help Keystart check for potential shortfalls.

- Complete Section 5 if accidental payments have occurred. Indicate the account details for refunding any payments received within four days prior to settlement.

- In Section 6, provide your email address or new mailing address if you are moving. This information is crucial for receiving any important notices.

- Section 7 requires you to read and agree to the declarations. Sign and date this section to authorize Keystart to process your discharge request as outlined.

- For multiple borrowers, ensure each borrower provides their details in Section 8. Each person must fill in their respective name and signature fields.

- Once all sections are filled out accurately, you can save your changes, download the completed form, print it for your records, or share it as needed.

Complete your AU Keystart Mortgage Discharge Request online today for a seamless transition.

To refinance, most lenders want you to have at least 20% equity in your home. You may have built your equity by paying more than the minimum monthly repayment or if your home has increased in value.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.