Loading

Get Irs 8453-ex 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8453-EX online

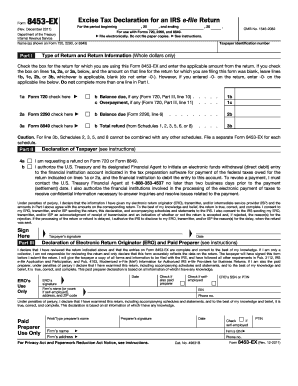

Filling out the IRS 8453-EX is an important step for ensuring your electronic excise tax returns are filed accurately. This guide will walk you through each section of the form to help you complete it correctly and efficiently.

Follow the steps to successfully complete the IRS 8453-EX form online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter your name as it appears on Forms 720, 2290, or 8849 in the designated field.

- Input your taxpayer identification number where indicated on the form.

- In Part I, check the box corresponding to the return you are submitting. Enter the applicable amounts from your return in the specified lines below the boxes.

- Proceed to Part II and check the box if you are requesting a refund. If you are authorizing electronic payment, ensure you provide the necessary banking details in your tax preparation software.

- Sign and date the form in Part III to declare the information is correct to the best of your knowledge.

- If applicable, have your electronic return originator (ERO) complete their information and declaration in Part III.

- After completing all fields, save your changes and ensure the form is in PDF format, ready for electronic submission with your return.

Complete your IRS forms online today to ensure timely processing and compliance.

If you are an ERO, you must mail Form 8453 to the IRS within 3 business days after receiving acknowledgement that the IRS has accepted the electronically filed tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.