Loading

Get Hi Vp-1 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI VP-1 online

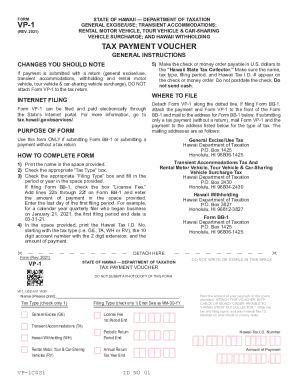

Filling out the HI VP-1 form online can simplify your tax payment process. This guide provides step-by-step instructions to ensure that you complete the form correctly and efficiently.

Follow the steps to accurately complete the HI VP-1 form online.

- Click the ‘Get Form’ button to access the HI VP-1 form and open it in your editor.

- In the space provided, print your name clearly. This ensures that your submission is easily identifiable.

- Mark the appropriate 'Tax Type' box by choosing only one option from General Excise (GE), Transient Accommodations (TA), Hawaii Withholding (WH), or Rental Motor, Tour & Car-Sharing Vehicles (RV).

- Select the 'Filing Type' by checking the corresponding box and entering the relevant date in MM-DD-YY format. Make sure to indicate if you are filing as a License Fee or for a periodic return.

- Provide your Hawaii Tax I.D. Number starting with the tax type abbreviation followed by your 10-digit account number and the 2-digit extension.

- In the designated field, print the amount of your payment clearly. This amount should be accurate to avoid discrepancies.

- Prepare a check or money order made payable in U.S. dollars to 'Hawaii State Tax Collector'. Include your name, tax type, filing period, and Hawaii Tax I.D. Number in the memo section of your payment.

- Detach the completed Form VP-1 along the dotted line. If you are filing Form BB-1, attach this voucher and your payment to the front of that form.

- Mail the completed Form VP-1 along with your payment to the appropriate address based on the tax type you are addressing.

- Once you have confirmed that all information is complete and accurate, save your changes, download, print, or share the form as needed.

Complete your HI VP-1 form and submit your tax payment online for a convenient experience.

In addition to form G-45, Hawaii General Excise Taxpayers must complete form G-49 (Annual Return & Reconciliation of General Excise / Use Tax Return) once a year. ... Form G49 is designed to give you credit for all of the taxes you paid, so if your gross income number is smaller than as expected, you may even get a refund.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.