Loading

Get Hk Ird Specimen On Completion Of Form Ir56g 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HK IRD Specimen On Completion Of Form IR56G online

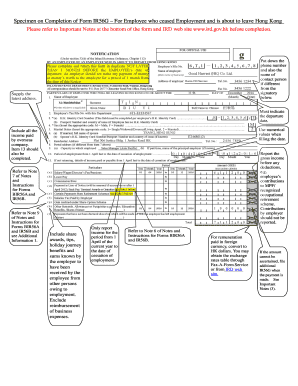

Filling out the HK IRD Specimen on Completion of Form IR56G is an essential process for individuals who have ceased employment in Hong Kong. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to successfully complete the HK IRD Specimen On Completion Of Form IR56G online.

- Click ‘Get Form’ button to obtain the form and access it in the online format.

- Provide the contact person's name and phone number if they differ from the signatory listed below this section.

- Enter your latest address, ensuring all details are accurate and up to date.

- Indicate the departure date using numerical values, reflecting the exact date you will leave Hong Kong.

- Include all income paid by your overseas company. Make sure to complete item 13 as specified.

- Report your gross income before any deductions, such as your contributions to the Mandatory Provident Fund or any recognized occupational retirement scheme. Do not include employer contributions.

- Refer to Note 7 in the instructions for further guidance on Forms BIR56A and IR56B for additional context.

- Record all relevant benefits including share awards, tips, holiday journey benefits, and any income received from other individuals due to employment. Exclude any business expense reimbursements.

- Only report the income earned from 1 April of the current year up to your cessation date as specified.

- For remuneration paid in foreign currency, convert the amounts to Hong Kong dollars using the current exchange rates provided on the IRD website.

- If there are amounts that cannot be determined at the time of filling out the form, plan to file a revised IR56G once the payment is made.

- Indicate whether the employer will cover the tax for the employee.

- The employer should withhold any moneys payable to the employee for one month from the filing date or until a Letter of Release is received.

- In cases where share options are exercised, ensure that gains are reported in Form IR56B.

- If your answer about share options is 'No', provide a reason for this determination.

- Complete the form with all required information and check for accuracy.

- Once completed, save your changes, and consider downloading or printing the form for your records.

Start completing the HK IRD Specimen On Completion Of Form IR56G online today for a smooth transition from your employment.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.