Get Mi Msa-115 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI MSA-115 online

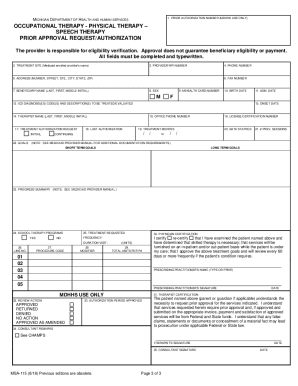

The MI MSA-115 form is crucial for Medicaid-enrolled providers seeking prior authorization for therapy services. This guide provides a clear and supportive walkthrough to help users efficiently complete the form online.

Follow the steps to successfully fill out the MI MSA-115.

- Press the ‘Get Form’ button to acquire the MI MSA-115 and open it in your preferred editor.

- In Box 2-3, enter the Medicaid enrolled provider’s name and National Provider Identifier (NPI) to accurately identify your organization.

- Complete Box 4-6 with the provider’s telephone number, address, and fax number, ensuring all information is correct and up to date.

- Fill in Box 7-10 with the beneficiary’s name (last, first, and middle initial), sex, mihealth card number, and birth date in MM/DD/YYYY format.

- In Box 11, specify the date the beneficiary was most recently admitted to the hospital or facility.

- Enter the beneficiary's diagnosis code(s) and description(s) in Box 12 that relate to the requested services.

- Fill out Box 13 with the date of onset for the diagnosis, including approximate dates for chronic disease exacerbations.

- Provide the therapist’s name, office telephone number, and license/certification number in Box 14-16.

- In Box 17, indicate whether this is an initial request or a request for continuing treatment.

- Complete Box 18 with the date of the last approved prior authorization request for the diagnosis.

- Specify the requested date range for treatment in Box 19, following the eight-digit date format.

- If treatment has already started, enter that date in Box 20.

- Record the total number of therapy sessions delivered since the development of the treatment plan in Box 21.

- Define measurable short and long-term goals in Box 22, providing specific expectations for the beneficiary.

- Document the beneficiary’s progress in Box 23, referencing the established goals and any relevant nursing or family education.

- Indicate if the beneficiary receives therapy through school-based services in Box 24.

- Detail the treatment plan frequency and duration per visit in Box 25 using clear increments.

- In Box 26, enter each unique HCPCS code/modifier for the services provided.

- Refer to the MDHHS website for the appropriate HCPCS codes in Box 27.

- Complete Box 28 with any necessary modifiers as specified in the Medicaid Provider Manual.

- Calculate and enter the total number of units for the services in Box 29.

- The prescribing practitioner must sign and date the certification in Box 30.

- The therapist must complete their certification in Box 31, ensuring all requests are properly signed.

- Boxes 32-35 are for MDHHS use only; do not fill these out.

- Finally, save the form and submit it electronically, by mail, or via fax as instructed, making sure to include all required supporting documentation.

Complete your MI MSA-115 online today to ensure timely prior authorization for therapy services.

The income limit to qualify for Medicaid in Michigan, specifically under the MI MSA-115 program, can vary based on family size and specific circumstances. Generally, individuals must meet certain monthly income thresholds to be considered eligible. It’s important to review the current guidelines, as these limits can change annually. If you need assistance understanding these limits or exploring eligibility options, uslegalforms can provide the necessary resources and support.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.