Loading

Get Za Uif Ui-7

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ZA UIF UI-7 online

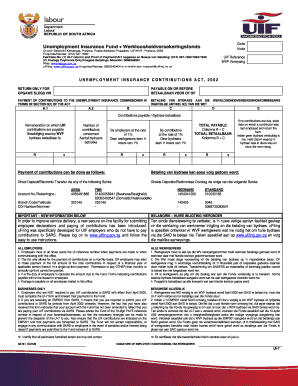

The ZA UIF UI-7 form is essential for reporting unemployment insurance contributions. This guide will help you navigate through filling out the form online, ensuring you provide accurate information for your submissions.

Follow the steps to successfully complete the ZA UIF UI-7 form online.

- Press the ‘Get Form’ button to access the ZA UIF UI-7 form online.

- Begin by entering your UIF reference number in the designated field. This is crucial for your submission.

- In section A, provide details of the contributions payable. Enter the total remuneration subject to UIF contributions in the specified field.

- Next, indicate the number of contributors concerned. Provide accurate information to reflect the contributors involved.

- In section B, specify the contributions payable by employers and contributors at the rate of 1%. Detail these figures accordingly.

- Calculate the total payable amount by summing the figures from section B and C; record this in the total payable section.

- If no contributions are due, state the date on which the last contributor was employed and return the form.

- Identify the method of payment you will use. Select from direct deposit or electronic transfer, and ensure you have the correct account details available.

- Finally, review all entered information for accuracy. Save your changes, and choose to download, print, or share the form if necessary.

Complete your ZA UIF UI-7 form online today for efficient processing.

UIF calculations in South Africa factor in the employee's gross monthly remuneration, with a contribution rate set at 2%. According to ZA UIF UI-7 guidelines, both the employer and employee contribute equally. These contributions determine the payout amount based on the employee's previous earnings when they file a claim.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.