Loading

Get Trust Questionnaire Form 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Trust Questionnaire Form online

Completing the Trust Questionnaire Form online can be a straightforward process with the right guidance. This guide aims to provide clear, step-by-step instructions for users of all experience levels.

Follow the steps to successfully complete your Trust Questionnaire Form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

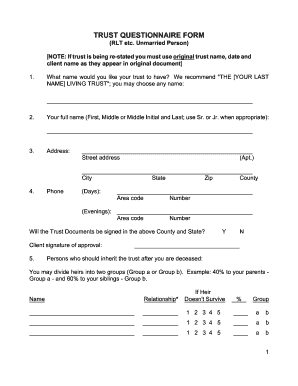

- Enter the name you would like your trust to have. A recommended format is 'THE [YOUR LAST NAME] LIVING TRUST', but you may choose any name that you prefer.

- Provide your full name, including your first, middle (or middle initial), and last name. If applicable, include designations such as Sr. or Jr.

- Fill in your address, including street address, apartment number (if any), city, state, zip code, and county.

- Input your phone number. Include area codes for both daytime and evening contact numbers.

- Indicate whether the Trust Documents will be signed in the county and state you provided by selecting 'Yes' or 'No'.

- List the individuals who should inherit from your trust after your passing. You may categorize them into two groups (Group a and Group b), and specify percentages for each heir. Ensure that the percentages total 100%.

- Identify persons who should inherit your estate if all individuals listed in the previous step are deceased. Only list individuals who will not inherit under the previous question.

- Specify if any family member will be intentionally excluded from inheriting by providing their names and relationships.

- Select a postponement option for possession of the inheritance for young or financially inexperienced heirs. Clearly state the ages or amounts for the selected option.

- Answer whether an heir should forfeit their share if they challenge the trust. Also specify if their descendants should forfeit as well.

- Designate who should serve as the successor trustee if you are unable to do so. Provide up to three choices.

- If applicable, mention who should direct investments if different from the successor trustee.

- Provide names for individuals you trust to make your health care decisions if you become mentally incompetent.

- List guardians for any minor children, specifying first and second choices.

- Indicate whether you want a living will by selecting 'Yes' or 'No'.

- If you indicated 'Yes' for a living will, specify if you want to be cremated and if you wish to donate your organs for transplant.

- For Arizona trusts, specify who should resolve any disputes between the trustee and a trust beneficiary. This will be a non-binding decision.

- After completing all necessary fields, make sure to save your changes, and you may now download, print, or share the form as needed.

Begin filling out your Trust Questionnaire Form online today to ensure your wishes are documented.

Basic trust types: The four main types of trusts are living trusts, testamentary trusts, revocable trusts, and irrevocable trusts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.