Loading

Get Tx Comptroller 01-116-a 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

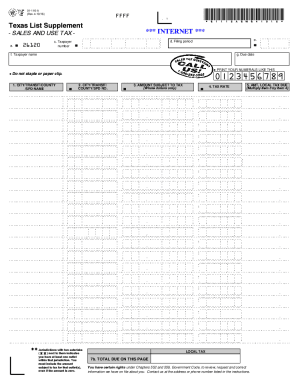

How to fill out the TX Comptroller 01-116-A online

Filling out the TX Comptroller 01-116-A form online can streamline your tax reporting process. This guide offers a clear, step-by-step approach to ensure you successfully complete each section of the form.

Follow the steps to complete the TX Comptroller 01-116-A form online.

- Press the ‘Get Form’ button to access the TX Comptroller 01-116-A form and open it for editing.

- In the 'Taxpayer number' field, input your unique taxpayer identification number to confirm your identity and tax account.

- Enter your 'Taxpayer name' in the designated area, ensuring it matches the name associated with your taxpayer account.

- Specify the 'Filing period' during which the sales occurred. This period is crucial for accurate tax calculation.

- Indicate the due date for your tax submission. This will help you keep track of filing deadlines.

- Under the 'CITY/TRANSIT/COUNTY/SPD NAME' section, enter the respective local jurisdiction names that apply to your sales activity.

- Next to each jurisdiction, the 'NO.' corresponds to a specific code; ensure you accurately input this information for processing.

- In the 'Amount subject to tax' field, list the total sales amount for each outlet in whole dollars only, even if the amount is zero.

- Apply the appropriate 'Tax rate' to the amount subject to tax to calculate the local tax due efficiently.

- Calculate the 'Amount local tax due' by multiplying the total amount subject to tax by the tax rate provided.

- Finally, review the 'Total due on this page' for accuracy. Make sure all calculations reflect your actual figures.

- Once all fields are completed, you can save your changes, download the form, or print it directly from the online platform.

Complete your tax filings efficiently by filling out the TX Comptroller 01-116-A online today.

How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.