Loading

Get Ma Redstone Accounting Services Client Tax Organizer/drop Off Sheet 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA Redstone Accounting Services Client Tax Organizer/Drop Off Sheet online

Filling out the MA Redstone Accounting Services Client Tax Organizer/Drop Off Sheet online can streamline your tax preparation process. This user-friendly guide provides clear, step-by-step instructions for each section of the form, ensuring you understand how to provide accurate and complete information.

Follow the steps to fill out the form with ease

- Click ‘Get Form’ button to retrieve the document and display it in your preferred editor.

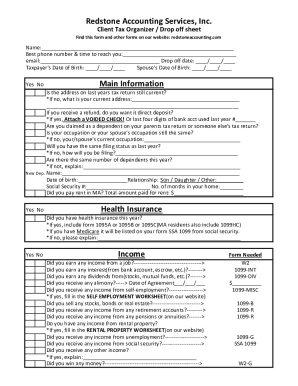

- Begin by entering your personal information in the designated fields. This includes your name, best phone number and time to reach you, email address, drop-off date, taxpayer's date of birth, and spouse's date of birth.

- Navigate to the section titled 'Main Information.' Here, confirm whether your address from last year's tax return is still current. If it has changed, provide your current address.

- Indicate if you wish to have your tax refund directly deposited by marking 'Yes' or 'No.' If yes, ensure that you either attach a voided check or note the last four digits of the bank account used last year.

- Answer the questions regarding your dependency status, occupation, filing status, and the number of dependents you will claim this year. Provide additional information where prompted.

- In the 'Health Insurance' section, confirm whether you had health insurance this year. Include necessary forms such as 1095A, 1095B, or 1095C for Massachusetts residents.

- Proceed to the 'Income' section where you will need to indicate all sources of income. This includes wages, interest, dividends, self-employment income, and any other relevant income streams.

- If applicable, fill out the 'Form Needed' section by listing the relevant forms such as W2, 1099-INT, etc.

- Next, address the 'Stimulus Check' question. Fill in the amounts received if applicable.

- Continue to the 'Adjustments' section and provide information on IRA contributions, student loan interest payments, and HSA usage.

- In the 'Credits' section, provide details about daycare expenses or education costs. Include any relevant identification numbers for daycare providers.

- Complete the 'Itemized Deductions' section by indicating any medical expenses exceeding 7.5% of your income and other deductions.

- Once all sections have been filled out, review your answers for accuracy. Sign and date the document in the provided space.

- Finally, save your changes, download, print, or share the completed form as necessary.

Start filling out your documents online today for a seamless tax preparation experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.