Loading

Get Ny It-558-i 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-558-I online

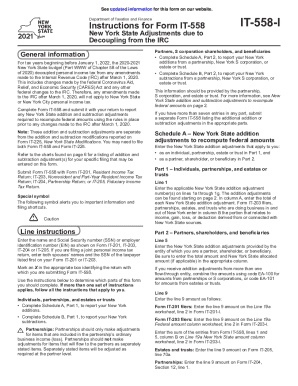

This guide provides a comprehensive overview of how to fill out the NY IT-558-I form online. By following these steps, users can accurately report their New York State addition and subtraction adjustments while ensuring compliance with state tax regulations.

Follow the steps to complete each section of the NY IT-558-I form.

- Use the ‘Get Form’ button to access the NY IT-558-I form and open it in your preferred document editor.

- Begin by filling out your personal information at the top of the form, including your name, Social Security number, and address. Ensure that this information matches any previous tax records.

- Proceed to Schedule A to report your New York State addition adjustments. In Part 1, enter the applicable addition adjustment numbers from the list provided in the instructions. For each adjustment, include the total amount in the appropriate column.

- If you are a partner, shareholder, or beneficiary, complete Part 2 of Schedule A. Enter the entity's name and your Social Security number or employer identification number, and input the addition adjustments as reported by the entity.

- Move on to Schedule B to record New York State subtraction adjustments. Similar to Schedule A, begin by entering the applicable subtraction adjustment numbers and total amounts for Part 1 in the indicated columns.

- For partners, shareholders, and beneficiaries, complete Part 2 of Schedule B, entering the relevant information as specified in the instructions.

- Review the entire form for accuracy, ensuring that all required fields are completed and any calculations are correct.

- Once the form is finalized, save your changes. You can then download, print, or share the completed form as needed for your tax filing.

Complete your tax documents online today for a smoother filing experience.

For couples filing jointly, the exemption is $20,400. But the State of New York is forgiving nothing, which can be tough for folks that have already filed their taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.