Loading

Get Va Cu-7 2001-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA CU-7 online

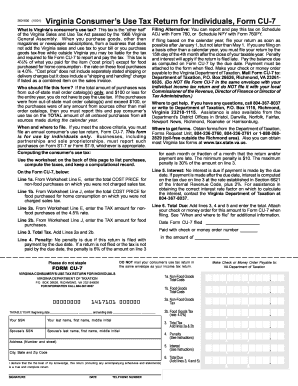

Filling out the Virginia Consumer's Use Tax Return for Individuals, Form CU-7, is essential for reporting and paying the consumer's use tax on applicable purchases. This guide provides clear steps to help you successfully complete the form online.

Follow the steps to complete the VA CU-7 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your personal information, including your Social Security Number (SSN), full name, and address in the designated fields.

- Indicate the taxable year for which you are filing at the top of the form by entering the starting and ending dates.

- Complete Line 1a by entering the total cost price for non-food goods purchased without sales tax. This value should be calculated using the worksheet provided.

- Complete Line 1b by entering the total cost price for food purchased without sales tax.

- On Line 2a, enter the tax amount computed for non-food purchases at the 4.5% rate.

- On Line 2b, enter the tax amount for food purchases calculated at the 4.0% rate.

- Calculate the total tax by adding lines 2a and 2b, and enter this value on Line 3.

- Determine any applicable penalty, if the return is filed late, and enter it on Line 4.

- If applicable, calculate interest on the tax due and enter it on Line 5.

- Add the total tax (Line 3), penalty (Line 4), and interest (Line 5) and enter the total due on Line 6.

- Finally, sign and date the form, and include your telephone number.

- Attach your check or money order for the total amount due to the form when filing.

- Save your changes, download, print, or share the completed form as needed.

Complete your VA CU-7 online to ensure compliance and timely submission.

Related links form

The sales tax rate for most locations in Virginia is 5.3%....Sales Tax Rates. General Sales Tax RateIn these locations5.3%Everywhere elseFood & Personal Hygiene Items1%Statewide3 more rows

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.