Loading

Get Uk Hmrc P14/p60 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC P14/P60 online

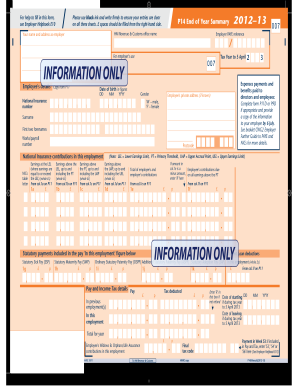

The UK HMRC P14/P60 forms are essential documents for reporting employee earnings and tax deductions at the end of the tax year. This guide provides you with clear, step-by-step instructions on how to accurately fill out these forms online.

Follow the steps to complete the HMRC P14/P60 form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the employer information section. Include your name, address, and the HM Revenue & Customs office name relevant to your business.

- Enter the tax year date at the top of the form, specifying the end date as 5 April of the relevant year.

- Input the employer PAYE reference number where indicated on the form for your records.

- Fill in the employee details section. This includes their date of birth, gender, National Insurance number, and private address if known.

- Report the employee's earnings and contributions as indicated, including specifics like statutory payments and deductions. Use the relevant columns, referring to figures from the P11 form.

- Verify the totals for pay, tax deducted, and any statutory benefits such as maternity or sick pay, ensuring it reflects the total for the year.

- Check for any corrections needed, such as refund indications, and complete the forms accordingly.

- After ensuring all fields are accurately filled, save your changes. You may then download, print, or share the completed form as required.

Begin filling out your HMRC P14/P60 online to ensure you meet your reporting obligations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To obtain a copy of your P60 in the UK, you should first contact your employer, as they are responsible for issuing these documents. Employers typically provide P60s by the end of May following the tax year, but you can always request a duplicate if you need one. If you find this process overwhelming, let USLegalForms help you with your request and offer expert advice.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.