Loading

Get Uk Hmrc Iht404 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC IHT404 online

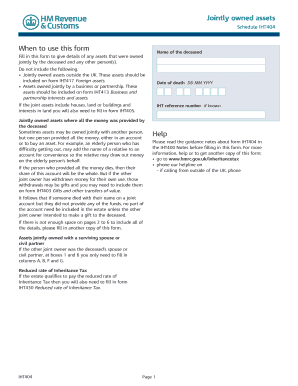

The UK HMRC IHT404 form is essential for reporting jointly owned assets of a deceased individual. This guide will walk you through each section of the form, providing clear and supportive instructions to help ensure you fill it out correctly.

Follow the steps to successfully complete the IHT404 form online.

- Use the ‘Get Form’ button to access the form and open it in your editor.

- Enter the name of the deceased in the specified field, ensuring you also provide the date of death in the DD MM YYYY format.

- If known, input the IHT reference number in the designated area.

- In the section regarding jointly owned assets, fill out details for each asset where all funds were provided by the deceased. Include asset descriptions, names of other joint owners, and the corresponding values.

- Document any liabilities related to the jointly owned assets, such as loans or mortgages, in the appropriate sections. Ensure these figures are accurate and reflect the total amount outstanding at the date of death.

- If applicable, note any exemptions or reliefs for the jointly owned assets and provide details as required.

- Complete the section for additional jointly owned assets, ensuring all details about the other assets, including their values and joint owners, are accurately filled in.

- Review all information entered for any discrepancies or missing data. Make corrections as needed.

- Once completed, save your changes. You can then choose to download, print, or share the form electronically, depending on your needs.

Begin filling out the UK HMRC IHT404 form online today to manage your inheritance tax responsibilities effectively.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Once HMRC accepts your IHT claim, it generally takes around 4 to 6 weeks to issue any repayments. An early submission, along with complete documentation, can expedite this timeline. For those navigating UK HMRC IHT404 matters, a timely research into repayments can provide financial relief.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.