Loading

Get Pa Form 531 - Cumberland County 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

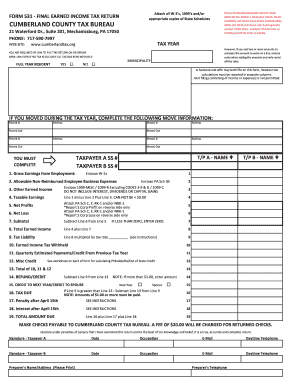

How to fill out the PA Form 531 - Cumberland County online

Filing your PA Form 531 is essential for fulfilling your tax obligations in Cumberland County. This guide will take you through each step of the process to ensure you complete the form efficiently and accurately.

Follow the steps to fill out the PA Form 531 online.

- Press the ‘Get Form’ button to access the PA Form 531. This will enable you to open the form in your preferred editing tool.

- Indicate your residency status by checking either 'yes' for full-year resident or 'no' for non-resident.

- Complete the move information section if applicable. Provide your move-in and move-out addresses along with the relevant dates.

- Fill in the 'Taxpayer A' and 'Taxpayer B' sections, entering names and social security numbers as required.

- List your gross earnings from employment in Line 1. Ensure you enclose copies of your W-2 forms.

- Complete Line 2 for allowable non-reimbursed employee business expenses, attaching the necessary PA Schedule UE.

- For Line 3, input any other earned income such as amounts from 1099-MISC or 1099-R forms as specified. Avoid including interest or dividends.

- Calculate taxable earnings in Line 4 by subtracting Line 2 from Line 1 and adding Line 3. Ensure the amount is not less than zero.

- Proceed to Line 5 for net profits, if applicable, and attach the necessary PA schedules.

- Continue filling the remaining lines (6 to 19), following the form’s instructions for calculations as required.

- Once all fields are completed and reviewed, save your changes. You can then download the form, print it for your records, or share it with the appropriate authorities.

Complete your PA Form 531 online to ensure timely filing and compliance with Cumberland County tax regulations.

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.