Loading

Get Jm General Consumption Tax Return Form 4a 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the JM General Consumption Tax Return Form 4A online

Completing the JM General Consumption Tax Return Form 4A online is an essential duty for businesses subject to general consumption tax. This guide provides a clear, step-by-step process to help users fill out the form accurately and efficiently.

Follow the steps to successfully complete your form online.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

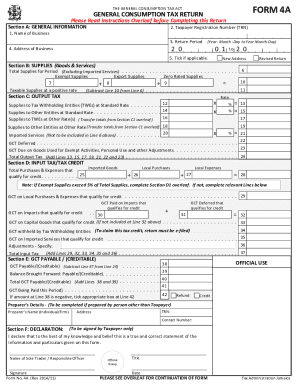

- Complete Section A by providing your general information, including your Taxpayer Registration Number, name of the business, return period, and address of the business. If applicable, indicate if you have a new address or if this is a revised return.

- In Section B, input the total supplies for the period while excluding imported services. You must also categorize supplies into exempt, export, and zero-rated supplies as necessary.

- For Section C, calculate the output tax by entering the relevant data regarding tax on supplies to tax withholding entities and other entities at the standard rate. Ensure you total these amounts as specified.

- Proceed to Section D and report the total purchases and expenses that qualify for credit. Include details on imported goods, local purchases, and local expenses.

- If your exempt supplies exceed 5% of total supplies, complete Section D1 for GCT that qualifies for credit. Otherwise, continue to fill out Section D with the relevant input tax values.

- In Section E, calculate the GCT payable or creditable by subtracting your total input tax from the total output tax. Indicate how to treat excess input tax if applicable.

- Finalise your form by completing the declaration section with your name, signature, title, and date. Ensure the form is signed only by the taxpayer.

- Once all fields are filled accurately, save changes, download your form for records, print it if necessary, or share it as required.

Complete your JM General Consumption Tax Return Form 4A online to ensure compliance with tax regulations.

General consumption tax (GCT) The provision of telephone services (including phone cards) and handsets is subject to GCT at the rate of 25%, while the tax is imposed on hotels and other businesses in the tourism sector at an effective rate of approximately 10%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.