Loading

Get Ct Ct-ifta-2 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT CT-IFTA-2 online

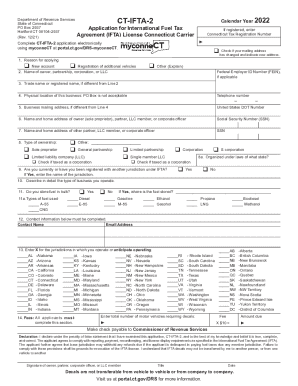

This guide provides a comprehensive overview of how to complete the CT CT-IFTA-2 Application for International Fuel Tax Agreement (IFTA) License online. Designed for users of all experience levels, this step-by-step process aims to streamline your application submission.

Follow the steps to successfully complete and submit your application.

- Click the ‘Get Form’ button to access the CT CT-IFTA-2 application form.

- Indicate the reason for applying in Line 1. Check the appropriate box for a new account, registration of additional vehicles, or other applicable reasons.

- In Line 2, enter the name of the owner, partnership, corporation, or LLC. If applicable, provide the Federal Employer ID Number (FEIN).

- Line 3 requires you to enter the trade name or registered name if it differs from the name in Line 2.

- Provide the physical address of the business in Line 4, ensuring it's not a P.O. Box.

- Line 5 asks for the business mailing address if it differs from the physical location provided in Line 4.

- Fill out Line 6 with the name and home address of the owner, partner, LLC member, or corporate officer. Identify the role accordingly (owner, partner, LLC member, officer).

- In Line 7, provide the name and home address of any other partner, LLC member, or corporate officer, including their Social Security Number (SSN).

- Line 8 requires you to check the appropriate box for your type of ownership. If your ownership is 'Other', specify it in the provided space.

- In Line 9, indicate if you have been registered with another jurisdiction under IFTA. If so, enter the jurisdiction's name.

- Describe your business operations in detail in Line 10.

- In Line 11, check if you store fuel in bulk. If yes, state where the fuel is stored.

- Line 11a asks you to specify the types of fuel used by entering an 'X' next to appropriate options.

- Complete Line 12 with the contact name and email address for correspondence.

- In Line 13, indicate the jurisdictions in which you operate or plan to operate by marking an 'X' next to each relevant jurisdiction.

- Line 14 requires you to enter how many motor vehicles need IFTA decals. Calculate the fee accordingly.

- Ensure the application is signed by the authorized person and includes their title and date.

- Finally, after completing the form, save your changes and choose to download, print, or share the application as needed.

Complete your CT CT-IFTA-2 application online today to ensure compliance and timely processing.

IFTA – or the International Fuel Tax Agreement – is a way to simplify how truckers and trucking companies pay their fuel taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.