Loading

Get Uk Hmrc Cf411a 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC CF411A online

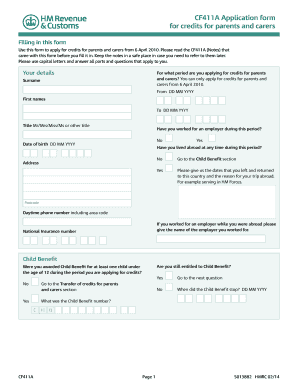

The UK HMRC CF411A form allows individuals to apply for credits for parents and carers, effective from 6 April 2010. This guide will provide clear and concise instructions to help users navigate through the form efficiently and accurately.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to access the CF411A form and open it in the designated editor.

- Enter your personal details in the designated fields. Specify the period for which you are applying for credits from 6 April 2010 and provide your surname and first names.

- State your title (e.g., Mr, Mrs, Miss, Ms) and provide your date of birth. Indicate whether you have worked for an employer during the specified period by selecting ‘Yes’ or ‘No’.

- If you answered ‘Yes’ to having worked for an employer, include information about your employment while abroad, including the employer's name if applicable.

- Provide your current address and postcode, as well as your daytime phone number including the area code.

- If applicable, answer questions regarding your Child Benefit entitlement. Specify whether you were awarded Child Benefit for a child under 12 during the applicable period.

- Detail the children you received Child Benefit for, including their full names, dates of birth, and the details of the non-claiming parent.

- If transferring credits, indicate whether you wish to transfer credits from the Child Benefit claimant’s National Insurance account. Provide relevant dates and information as requested.

- If you are a foster parent or kinship carer (Scotland), fill in the relevant sections with dates and confirmation letter details from your local authority.

- Once all sections are complete, review your information for accuracy. Then save your changes, download, print, or share the completed form as needed.

Complete your HMRC CF411A application online to ensure you receive your credits for parents and carers.

In certain circumstances, grandparents may be able to claim financial support for looking after their grandchildren in the UK. Eligibility often depends on specific conditions, such as the nature of the care provided and residency status. Connection with rules under UK HMRC CF411A can help clarify any potential claims for financial assistance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.