Get Sg Uob Request For Letter Of Credit Negotiation 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SG UOB Request for Letter of Credit Negotiation online

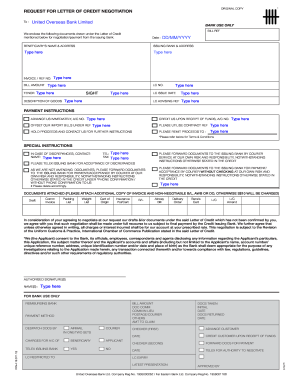

The SG UOB Request for Letter of Credit Negotiation is a crucial document used to initiate the negotiation of payment for goods through a letter of credit. This guide provides a detailed, step-by-step process to assist users in completing the form accurately and efficiently.

Follow the steps to complete the SG UOB Request for Letter of Credit Negotiation form.

- Click the ‘Get Form’ button to access the SG UOB Request for Letter of Credit Negotiation form. This will allow you to open the document in an editable format.

- Fill in the date of the request in the designated area labeled 'Date'. Ensure you use the format DD/MM/YYYY.

- Enter the beneficiary’s name and address in the respective fields. This identifies the party receiving payment under the letter of credit.

- Fill in the 'Issuing Bank' and its address. This section provides the details of the bank that issued the letter of credit.

- Input the invoice/reference number and the bill amount in the appropriate fields, along with the tenor of the negotiation.

- Complete the 'LC No.' and 'LC Issue Date' sections to specify the letter of credit being negotiated.

- Provide a description of the goods included in the transaction to clarify the nature of the invoice.

- In the payment instructions section, include details such as advance payment requests, offsets for import bills, and any contract references that apply.

- Under special instructions, indicate whom to contact in case of discrepancies, providing a name and telephone number.

- Attach the necessary documents as indicated in the 'Documents Attached' section. Ensure you have included any additional invoices and bill of lading as required.

- Review all entered information for accuracy and completeness before submission.

- After filling out the form, you can save changes, download, print, or share the document as needed.

Complete your documents online today for a smooth negotiation process!

Typically, the amount, expiration date, and shipping terms of a letter of credit can be negotiable elements. Conversely, the underlying contract terms and basic terms for payment recognition are generally non-negotiable. Understanding these distinctions is crucial when dealing with the SG UOB Request for Letter of Credit Negotiation. This clarity helps in aligning expectations with all parties involved.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.