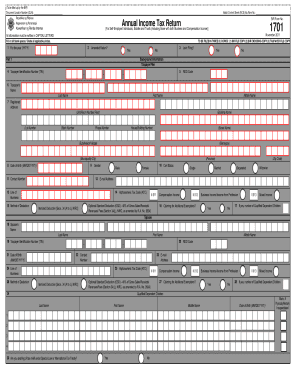

Get Ph Bir Form 1701 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PH BIR Form 1701 online

Filing the PH BIR Form 1701 is an essential task for self-employed individuals, estates, and trusts in the Philippines. This guide aims to provide clear, step-by-step instructions to help users successfully complete the form online, ensuring compliance with national tax regulations.

Follow the steps to fill out the PH BIR Form 1701 online.

- Press the ‘Get Form’ button to access the form and open it for editing.

- Enter the Document Locator Number (DLN) in the designated field at the top of the form. Ensure all information is written in capital letters.

- Complete the Batch Control Sheet (BCS) Number or Item Number if applicable.

- Indicate the tax year by filling in the 'For the year (YYYY)' section.

- Specify if the return is an amended return by selecting 'Yes' or 'No'.

- Fill in the RDO Code accurately, as this identifies the Revenue District Office where you are registered.

- Input your Taxpayer Identification Number (TIN) in the provided fields, formatted correctly.

- Complete the taxpayer's name fields, ensuring to enter the last name, first name, and middle name as required.

- List the registered address accurately, including details such as unit/room number, building name, street name, barangay, municipality/city, province, and zip code.

- Provide your date of birth in the specified format (MM/DD/YYYY), and indicate your gender.

- Fill in your civil status by marking the appropriate box and providing a contact number and email address.

- Identify your line of business and select your method of deduction—either optional standard deduction or itemized deduction—by shading the appropriate circle.

- If applicable, state the number of qualified dependent children for additional exemptions.

- Continue filling out remaining income fields and deductions as required, ensuring all sections are fully completed.

- Once all information is filled in, save the changes, download the completed form, and print or share it as needed.

Complete your PH BIR Form 1701 online today to ensure timely filing and compliance with tax regulations.

Get form

The annual return of income tax is a requirement that mandates taxpayers to report their total annual income and calculate the taxes owed. By completing the PH BIR Form 1701, you provide an overview of your finances for the tax year. This return captures necessary information that influences your tax obligations, ensuring proper compliance with tax regulations. It’s an essential aspect of responsible financial management.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.