Loading

Get Ca Atascadero Small Business Emergency Grant Program Application 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Atascadero Small Business Emergency Grant Program Application online

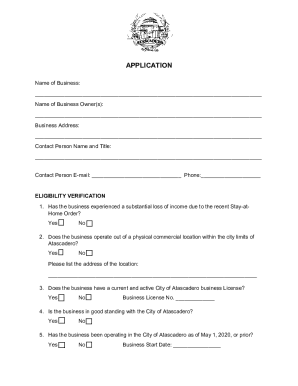

The CA Atascadero Small Business Emergency Grant Program is designed to provide immediate financial assistance to small businesses affected by the COVID-19 pandemic. This guide offers clear instructions on how to complete the application form online, ensuring that your business receives the support it needs.

Follow the steps to complete your application effectively.

- Press the ‘Get Form’ button to access the application form and open it in your preferred online editor.

- In the application form, begin by entering the name of your business in the designated field.

- Next, provide the name of the business owner or owners, ensuring you include all relevant individuals.

- Fill out the business address accurately, including street, city, state, and zip code.

- Identify the contact person for your business by inputting their name and title in the specified sections.

- Enter the contact person’s email address and phone number for further communication.

- For eligibility verification, answer the series of yes/no questions regarding your business operations and conditions. Provide additional information as prompted.

- Indicate the amount of grant funds you are requesting, noting that the maximum available is $5,000.

- In the section describing how the grant funds will be used, provide detailed information on your business needs and how the funds will assist in sustaining operations.

- Complete the additional information section, especially regarding prior assistance received and any future plans for business operations.

- Sign the City of Atascadero Grant Agreement Form, acknowledging the terms and conditions outlined in the application.

- Once all fields are filled out, review your application for accuracy. Save any changes made, and choose to download, print, or share the completed form as required.

Take the necessary steps to complete your application online and secure essential funding for your business.

It lets eligible taxpayers pay an elective 9.3% tax on their income, which they can then claim as a nonrefundable credit on their personal tax returns. Because AB 150 responds to the Tax Cuts and Jobs Act, it will become null and void should the TCJA be repealed, or upon its expiration in 2026.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.