Loading

Get Tx Form 50-113 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Form 50-113 online

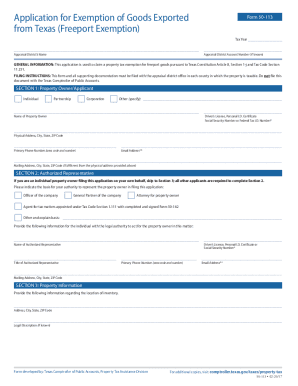

This guide provides clear and supportive instructions on how to accurately complete the TX Form 50-113 online. This application is essential for claiming a property tax exemption for goods exported from Texas under the Freeport Exemption.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by filling out the tax year in the designated space at the top of the form. This indicates the year for which you are applying for the exemption.

- In Section 1, provide information about the property owner or applicant. Indicate whether the owner is an individual, partnership, corporation, or other. Fill in the name, identification details, physical address, primary phone number, and email address.

- If applicable, complete Section 2 to provide information about an authorized representative. Indicate the basis for their authority and fill out their contact details.

- Proceed to Section 3 to provide property information. Fill in the location of the inventory, legal descriptions, and answer the questions regarding the transportation of goods out of state.

- Answer questions about the cost of goods sold and provide necessary documentation regarding records that support your financial information.

- In Section 4, attach the required documents outlining the types of items in your inventory.

- Finally, review Section 5 for the certification and signature. Ensure that the printed name, signature, and date are accurately filled out.

- Once all sections are completed and verified, save your changes. You may download, print, or share the completed TX Form 50-113 as needed.

Complete your TX Form 50-113 online to ensure you receive the appropriate tax exemption for your exported goods.

Federal and Texas government entities are automatically exempt from applicable taxes. Nonprofit organizations must apply for exemption with the Comptroller's office and receive exempt status before making tax-free purchases.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.