Loading

Get Ky Form 765 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY Form 765 online

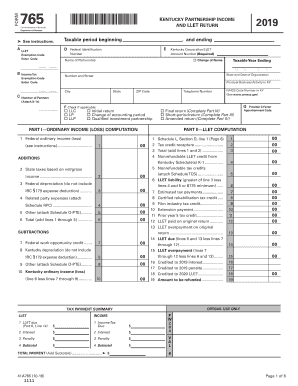

The KY Form 765 is the Kentucky partnership income and limited liability entity tax return. This guide provides you with a step-by-step approach to filling out this form online, ensuring all necessary details are accurately reported.

Follow the steps to complete the KY Form 765 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the taxable period for the form, specifying the beginning and ending dates clearly.

- Provide your federal identification number and Kentucky corporation/LLET account number in the specified fields.

- Fill in the name of the partnership and the principal business activity conducted in Kentucky, along with the city, state, ZIP code, and telephone number.

- Check any applicable boxes, such as LLC, initial return, or change of accounting period.

- Complete the additions and subtractions sections by providing the required financial information as outlined in the form. Ensure accuracy in figures for state taxes, federal depreciation, and any related expenses.

- Answer questions in Part III regarding the final return and Part IV for any amendments, providing necessary explanations.

- Sign and date the form where indicated, recalling that the declaration must be true to the best of your knowledge.

- Finally, save your changes, and upon reviewing your entries, proceed to download or print the completed form for submission.

Complete your documents online today to ensure timely filing and compliance.

Related links form

A single member LLC whose single member is an individual, estate, trust, or general partnership must file a Kentucky Single Member LLC Individually Owned Income and LLET Return (Form 725) or a Kentucky Single Member LLC Individually Owned LLET Return (Form 725-EZ) to report and pay any LLET that is due.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.