Loading

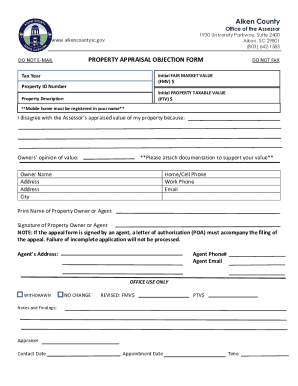

Get Sc Property Appraisal Objection Form - Aiken County 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC Property Appraisal Objection Form - Aiken County online

Navigating the appeal process for property appraisals can be straightforward with the right guidance. This guide provides clear, step-by-step instructions on how to effectively fill out the SC Property Appraisal Objection Form for Aiken County online.

Follow the steps to complete your appraisal objection form online.

- Click ‘Get Form’ button to access the SC Property Appraisal Objection Form and open it in your preferred online editor.

- In the 'Tax Year' field, enter the tax year for which you are disputing the appraisal. This is essential to identify the correct timeframe for your objection.

- Fill in the 'Initial Fair Market Value (FMV)' and 'Initial Property Taxable Value (PTV)' fields with the values provided in your assessment notice, ensuring accuracy to support your position.

- Provide your property ID number and a brief description of the property. If the property is a mobile home, ensure it is registered in your name.

- In the section stating your reason for disagreement, clearly articulate why you believe the appraised value is incorrect. This justification is crucial for the review process.

- Detail your opinion of value in the designated field. It is highly recommended that you attach supporting documentation, such as appraisals or comparable sales information, to strengthen your case.

- Enter the owner’s information, including name, address, and contact details such as phone numbers and email. This information must match official records.

- If someone is acting on your behalf, make sure their details are noted, and include a letter of authorization. This must be attached for the objection to be processed.

- Review your entries for accuracy. Once confirmed, proceed to save your changes, and choose to download or print the completed form as needed.

- Submit the form through the appropriate means, ensuring that you retain a copy for your records and consider using a delivery method with proof of receipt.

Start filling out the SC Property Appraisal Objection Form online to ensure your voice is heard in the appraisal process.

You may appeal a property tax assessment or the denial of a property tax exemption made by the Department of Revenue (“Department”) by filing a protest within 90 days of the date of the property tax assessment or the date of the notice setting forth the denial of the property tax exemption.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.