Loading

Get Ky Net Profit License Fee Return - City Of Marion 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY Net Profit License Fee Return - City Of Marion online

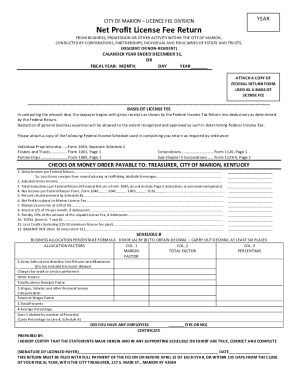

Filling out the KY Net Profit License Fee Return for the City of Marion is an essential process for businesses operating within the city. This guide provides a clear, step-by-step approach to completing the form online, ensuring that users have the necessary information to fulfill their obligations accurately.

Follow the steps to complete your return seamlessly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the calendar year or fiscal year at the top of the form to indicate the period for which you are filing. Ensure the dates are accurate to avoid discrepancies.

- Attach a copy of your Federal Income Return, which will serve as the basis for your license fee calculation. Check the box corresponding to your business structure (Corporation, Partnership, Individual, etc.).

- In the sections provided, start documenting your gross income per the Federal Return. Be thorough in accounting for all sources of income, as this will form the basis of your license fee.

- List any deductions as specified in the instructions, making sure to stick to the guidelines set by the Federal Return.

- Calculate your net income as indicated and input the respective figures for the different Federal Return forms you may be using (1040, 1041, etc.).

- Determine the percentage as calculated by Schedule B and input this figure into the appropriate field.

- Calculate the net profits subject to the Marion License Fee and ensure this is recorded accurately.

- Compute the Marion License Fee which is calculated at 3/4 of 1%, and include any interest or penalties applicable if your calculations indicate delinquency.

- Sum the applicable amounts to ascertain your total due, then subtract any credits you have, including a minimum license fee already paid.

- Lastly, calculate the balance due by subtracting your credits from the total calculated in the previous step. Make sure that all figures align correctly.

- Once you have filled in all fields, review your form for accuracy and completeness. Save your changes, and proceed to download, print, or share your completed form as necessary.

Start completing your KY Net Profit License Fee Return online today for a seamless filing experience.

Payroll Withholding Tax The Occupational Withholding tax rate is 1%. This tax is on all wages and compensation for work done or services performed in the unincorporated area of Franklin County by every resident and non-resident who is an employee.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.