Loading

Get Canada T778 E 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T778 E online

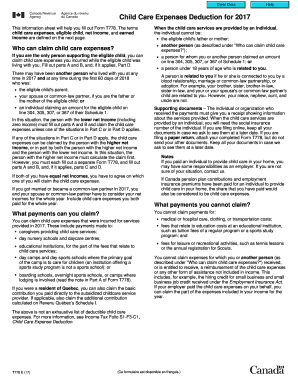

This guide provides a clear and supportive approach to filling out the Canada T778 E form for child care expenses. It is designed to help users navigate the components of the form with ease and confidence.

Follow the steps to successfully complete your Canada T778 E form online.

- Click the ‘Get Form’ button to access the Canada T778 E form and open it for editing.

- Begin with Part A, where you will list the first names and dates of birth of all eligible children. This section also requires you to input the child care expenses paid.

- Proceed to Part B to calculate the basic limit for child care expenses. You will provide the number of eligible children born in various years and multiply by the specified amounts.

- Enter your earned income in the specified field for Part B. This figure is necessary for determining the allowable deduction amount.

- If applicable, fill out Part C to indicate if you are the person with a higher net income. This part requires the name and net income of the other person.

- Continue to Part D if you or another person were enrolled in an educational program. Provide details regarding your education status during the year.

- Review all sections for accuracy. Once you are satisfied that all fields are filled, you can save changes, download, print, or share the completed form.

Fill out your Canada T778 E form online today for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Form T778 is typically claimed by the parent with the lower income or the one who primarily pays for child care expenses. It is essential to understand the eligibility criteria, particularly for shared custody situations. Using the Canada T778 E strategy can ensure both parents understand their deduction limits better, leading to effective tax planning and savings.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.