Get Canada T661 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T661 online

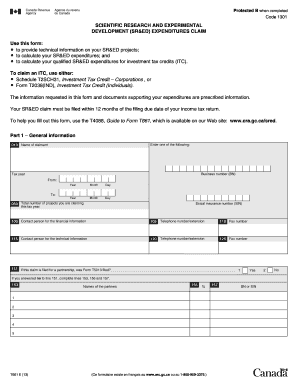

The Canada T661 form, also known as the Scientific Research and Experimental Development (SR&ED) Expenditures Claim, is crucial for claiming tax credits related to SR&ED projects. This guide will walk you through each section of the form, providing detailed and clear instructions to assist you in completing it online.

Follow the steps to successfully complete the Canada T661 form online.

- Press the ‘Get Form’ button to obtain the form and open it in your online editor.

- Begin by filling out Part 1 – General information. Provide your name as the claimant, business number, tax year, total number of projects for the tax year, and social insurance number (SIN). Include contact information for both financial and technical details.

- Complete Part 2 – Project information. This section requires a separate entry for each project. Fill in project identification including the title, start date, completion date, and relevant field of science or technology code.

- In Section B of Part 2, explain the scientific or technological uncertainties you attempted to overcome. Describe the work performed during the tax year to address these uncertainties and discuss any advancements achieved from this work.

- Provide personnel information under Section C, listing key individuals involved in the project along with their qualifications and experience. Also indicate whether you are claiming expenditures associated with work outside Canada or performed by non-employees.

- Move to Part 3 for calculating your SR&ED expenditures. Select the appropriate method for calculating these expenditures and complete the necessary sections detailing expenditures related to salaries, materials, contracts, and overhead.

- Fill out Part 4 to calculate the qualified SR&ED expenditures for investment tax credit purposes, ensuring accuracy in documenting current and capital expenditures.

- If applicable, complete Part 5 by calculating the prescribed proxy amount, which represents overhead and other expenditures, ensuring you do not complete this if using the traditional method.

- Review all sections for accuracy and completeness. Collect any supporting evidence for your claims, as you must keep this documentation for potential reviews in the future.

- Finalize the process by certifying the form. Provide the name and signature of the authorized signing officer, along with the date of certification, before submitting your claim online.

Begin filling out the Canada T661 form online today to claim your SR&ED tax credits.

Get form

Yes, Canada continues to accept refugees, maintaining its commitment to providing sanctuary to those in need. The Canadian government actively works to support refugees who face persecution in their home countries. Asylum seekers are encouraged to apply for protection, as Canada values human rights and dignity. Do not hesitate to seek help in understanding the application process for a seamless experience.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.